Industrial banks are only chartered by a few states; the state of Utah provides the majority of charters for industrial banks in the U.S. An investment bank is a financial services company that acts as an intermediary in large and complex financial transactions. An investment bank is usually involved when a startup company prepares for its launch of an initial public offering and when a corporation merges with a competitor.

- Many business credit products and services are available and match clients’ operational and strategic needs.

- One of the major bank is ‘National Bank for Agricultural and Rural development’ established in 1982, as an apex institution in the field of agricultural and other economic activities in rural areas.

- In short, the IDBI is the leader, coordinator and innovator in the field of industrial financing in our country.

- The major aim of the monitory policy is to stabilize the financial system of the country from the dangers of inflation, deflation, crisis, etc.

- While industrial banks have limited banking powers nationwide, they generally maintain the same powers and privileges as a traditional commercial bank.

- The cheque, bank draft, letter of credit, bills, hundies enable traders to transfer large sums of money from one place to another.

This bank was established for providing loan facilities, discounting and rediscounting of bills, direct assistance and leasing facility. The former has a three-tier structure consisting of state cooperative banks at the state level. At the intermediate level these are central co-operative banks, which are generally established for each district. At the base of the pyramid, there are primary agricultural societies at the village level. The main business of cooperative banks is to provide finance to agriculture.

Criticism of Industrial Banks

Over a dozen foreign exchange banks branches are working in India have their head offices in foreign countries. This dictionary definitions page includes all the possible meanings, example usage and translations of the word industrial bank. Unlike commercial banks, who are driven by profit, cooperative banks work on a “no profit, no loss” basis. All the commercial banks in India- Scheduled and Non-Scheduled is regulated under Banking Regulation Act 1949. The difference between the deposit and lending rate is called ‘net interest spread’, and the interest spread constitutes the banks income. Investopedia requires writers to use primary sources to support their work.

The Export-Import Bank of India was established on January 1, 1982 as a statutory corporation wholly owned by the central government. These banks perform the useful services of collecting small savings commercial banks also run “saving bank” to mobilise the savings of men of small means. Mutual savings bank, Post office saving, commercial saving banks etc. In the United States, an industrial bank can have branches located in multiple states, with the institution chartered in one of the states where it has a presence.

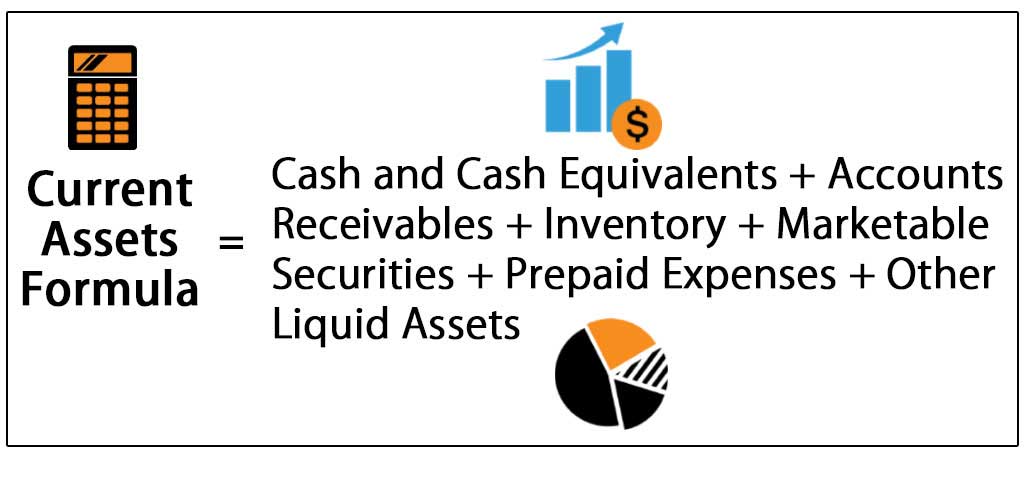

Commercial banks derive capital from customer deposits through checking, savings, money market accounts, and certificates of deposit. Customers are paid interest for providing banks with the working capital necessary to make loans. Of course, the interest rate paid by banks on money borrowed from customers is less than the interest rate charged on money loaned to customers.

It allows consumers to stay in their while and drive up to a machine equipped with a container, chute and intercom. This machine is connected to a bank and is run by one or two bank letters. A central bank is usually control and quite often owned, by the government of a country. The oxford dictionary defines a bank as “an establishment for custody of money received from or on behalf of its customers. It’s profits arises from the use of the money left employed by them“. Jammu & Kashmir Bank is an example of a non-scheduled commercial bank.

Industrial banks are distinguished from commercial loan companies because industrial banks accept deposits in addition to making consumer loans. Industrial banks are distinguished from commercial banks because industrial banks do not offer demand deposit accounts. An industrial loan company or industrial bank is a financial institution in the United States that lends money, and may be owned by non-financial institutions. ILCs offer FDIC-insured deposits and are subject to FDIC and state regulator oversight. They are regulated and supervised by state charters and insured by the Federal Deposit Insurance Corporation.

Types of Banking

A limited service financial institution that raises funds by selling certificates called „investment shares“ and by accepting deposits, and invests such funds in installment loans to consumers and to small businesses. Often such loans are industrial bank definition secured by a third party who signs a co-maker note pledging to repay the loan if the borrower defaults, or the loan is secured by a chattel mortgage. Industrial banks are sometimes called Morris Plan banks or industrial loan companies.

In order to use an ATM, a person must have an ATM card with a personal identification number and access to an ATM machine. As, in the past, it still involves bank tellers and specialized bank officers. Banking is described as the business carried on by an individual at a bank. Today, several forms of banking exist, giving consumers a choice in the way they manage their money most people do a combination of at least two banking types. These banks are established and controlled under the special act of parliament.

A bank is a financial institution which performs the deposit and lending function. A bank allows a person with excess money to deposit his money in the bank and earns an interest rate. Similarly, the bank lends to a person who needs money (investor/borrower) at an interest rate. Thus, the banks act as an intermediary between the saver and the borrower. A bank is a financial institution licensed to receive deposits and provide other services such as mortgage loans and individual retirement accounts. The advisory division of an investment bank is paid a fee for its services.

It allows a person to get on the internet and sign into their bank. This process is achieved with the use of a PIN, different from the one used for the ATM card. By going website of a bank and entering it, a consumer can get into his account, withdraw money, deposit money, pay bills, request loans and invest money. The Bill also adds a provision for directors to be elected by shareholders based on the total amount of equity share capital issued to such shareholders.

The polices of financing of these banks have been designed in such a way so that these institution can play catalyst role in the process of rural development. A chartered bank is a financial institution in the business of providing monetary transactions, such as safeguarding deposits and making loans. Industrial banks were originally founded in the early 1900s in order to provide low-to-moderate-income industrial workers who were unable to qualify for credit at traditional lending institutions with a means to access capital. An industrial bank is a state-chartered depository institution that can be owned by non-financial entities. Industrial banks are subject not to oversight by the Federal Reserve, but rather by the states in which they are formed. Investment banks are best known for their work as intermediaries between a corporation and the financial markets.

Industrial Banks vs. Commercial Banks

In other words, when you finance a car with BMW Bank of North America, you’re dealing with an industrial bank. They must follow the same banking laws and regulations that other banks do. They are regulated by the state in which they operate, and are supervised and insured by the Federal Deposit Insurance Corp. . Michael Boyle is an experienced financial professional with more than 10 years working with financial planning, derivatives, equities, fixed income, project management, and analytics.

A modern bank helps its customers to sent funds to anywhere and receive funds from anywhere of the world. By mobilizing savings, the banks channelize them into productive investments. Banks by playing attractive interest rate on deposits try to promote thrift and savings in an economy.

We’re doing our best to make sure our content is useful, accurate and safe. The Act specifies the term of office of a director to be not more than two years. The Bill also states that no director can hold office for a total period exceeding six years. The Regional Rural Banks Act, 1976 mainly provides for the incorporation, regulation and winding up of Regional Rural Banks .

Definition and Example of an Industrial Bank

People in developing countries have low incomes but the banks encourage them to save by introducing a variety of deposit schemes to suit the needs of individual depositors. He must fill out a slip with his account and the specific monetary amount and put it in the container. The container travels through the chute to the bank letter, who will complete the banker’s request. The bank teller and banker use it to communicate and discuss the specific banking request. Their main function is to discount, accept and collect foreign bulls of exchange. They also buy and self foreign currencies and help businessmen to convert their money into any foreign currency they need.

PSB accounts for close to 50% of total assets, 70% of deposits and close to 70% of the advances. Walmart Inc. withdrew its application in 2007 before the FDIC could make any decision regarding the status of their application. Opponents of Walmart’s application claimed that the company’s engagement in the business of banking posed a threat to the banking system and to the FDIC Deposit Insurance Fund. The FDIC eventually placed a temporary moratorium on industrial bank applications in 2006.

The bank also acts as a risk mitigator by allowing savers to deposit their money safely and also earns interest on the same deposit. Bank provides services like saving account deposits and demand deposits which allow savers to withdraw money on an immediate basis thus, providing liquidity with security. This opened the door for non-financial companies to own industrial banks in the states that allowed them. Their market share later began to decline as banks began to offer more consumer lending options for a greater number of customers. Over 93% of industrial banks have headquarters in Utah, a state known for its business-friendly policies.

In recent years, the IDBI has started providing assistance to backward areas and small-scale industries remarkably well. Purchasing or underwriting shares and debentures of industrial concerns. Providing technical and administrative assistance for promotion, management and expansion of industry. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia does not include all offers available in the marketplace. Marshall Hargrave is a stock analyst and writer with 10+ years of experience covering stocks and markets, as well as analyzing and valuing companies.

Other states permitting ILCs include California, Colorado, Minnesota, Indiana, Hawaii, and Nevada. The investment bank is responsible for examining a company’s financial statements for accuracy and publishing a prospectus that describes the offering in detail to investors before the securities are available for purchase. Many business credit products and services are available and match clients’ operational and strategic needs. Examples of industrial banks include the Industrial Bank of China, Industrial Bank of Iraq, and Industrial Bank of Korea. IN the U.S, industrial banks only exist in a few states, with the most presently in the state of Utah.

With the growth of banking activity, employment opportunity in the country has increased to a considerable extent. Industrial Bank does not share your contact information with any third-party vendors. Appointments are required for additional services such as opening an account, CD/IRA, accessing a safe deposit box and notary services.

So, a bank enables an economy to generate employment opportunities. Money deposited in the bank and other precious items are now absolutely safe. The cheque, bank draft, letter of credit, bills, hundies enable traders to transfer large sums of money from one place to another. Bank is a lawful organization which accepts deposits that can be withdrawn on demand. It also tends money to individuals and business houses that need it.

Neueste Kommentare